|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

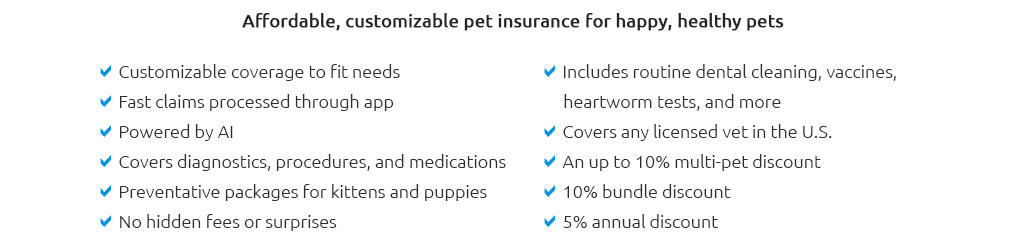

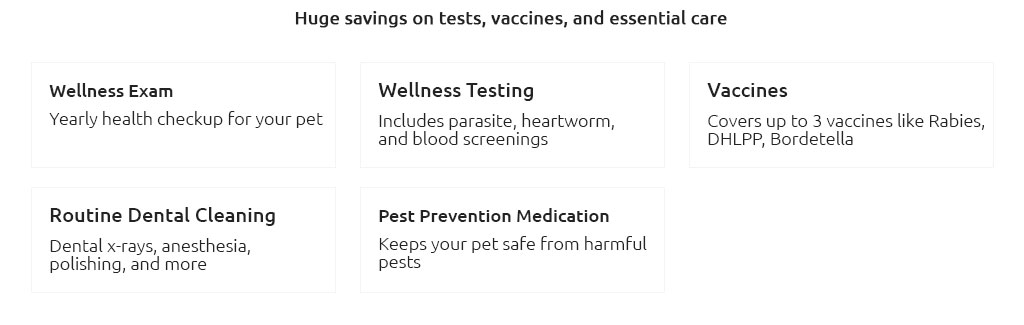

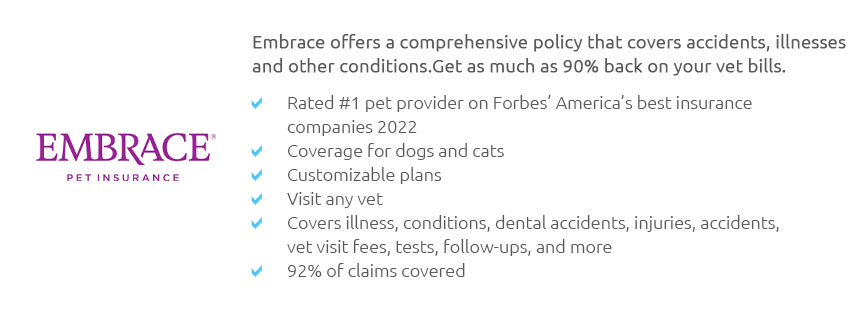

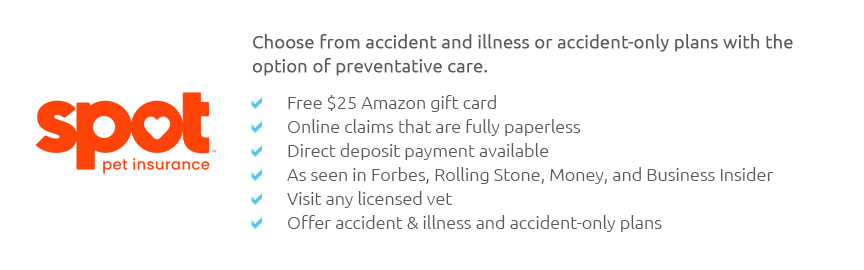

Understanding Health Insurance for Pets: Important ConsiderationsIn recent years, the concept of health insurance for pets has evolved from being a niche concern to a mainstream consideration for many pet owners. With veterinary costs on the rise, ensuring that one's furry family member receives the best care possible without breaking the bank has become a priority. However, navigating the myriad options available in the pet insurance landscape can be daunting. This article aims to elucidate some of the crucial factors that pet owners should contemplate when exploring health insurance options for their beloved companions. First and foremost, pet owners must consider the coverage types available. Generally, pet insurance policies fall into a few main categories: accident-only, time-limited, maximum benefit, and lifetime coverage. Accident-only policies are often the most affordable, providing coverage solely for injuries resulting from accidents. In contrast, lifetime policies offer the most comprehensive coverage, including chronic conditions and recurring illnesses, albeit often at a higher premium. Selecting the appropriate coverage type depends largely on the pet's age, breed, and existing health conditions. Equally important is the choice of insurer. Not all pet insurance providers are created equal, and it is essential to select a reputable company with a track record of fair and timely claim settlements. Customer reviews and ratings can provide valuable insights into an insurer's reliability. Moreover, understanding the exclusions and limitations of a policy is crucial. Many policies exclude pre-existing conditions, hereditary disorders, and certain breed-specific ailments, which may significantly impact the overall value of the insurance. Cost is another pivotal consideration. While it might be tempting to opt for the cheapest policy available, this approach can be short-sighted. Instead, pet owners should weigh the cost against the potential benefits. Factors affecting the premium include the pet's age, breed, location, and the selected coverage level. Comparing different plans and their respective costs can be instrumental in finding a policy that offers the best value for money. Furthermore, pet owners should pay attention to the claim process. A straightforward, hassle-free claims process can make a significant difference when accessing funds for urgent veterinary care. Some insurers offer direct billing options with veterinary clinics, which can alleviate the financial burden on pet owners at the time of treatment. Finally, considering the additional benefits some policies offer can be advantageous. Certain insurers provide coverage for complementary therapies, behavioral treatments, or even wellness programs that include vaccinations and routine check-ups. While these features may not be essential, they can enhance a pet's overall well-being and are worth considering. In conclusion, choosing health insurance for pets requires careful deliberation of various factors. By understanding the different coverage types, evaluating insurers, considering cost implications, scrutinizing the claims process, and recognizing the value of additional benefits, pet owners can make informed decisions that best suit their needs and those of their cherished pets. As veterinary care continues to advance, having a robust health insurance plan can provide peace of mind, knowing that one's pet will receive the care they deserve without causing undue financial strain. https://www.aspcapetinsurance.com/dog-insurance/

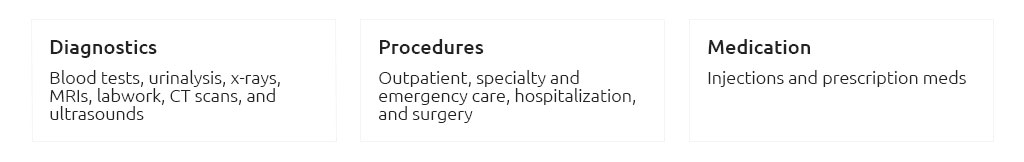

Complete Coverage SM for Dogs starting as low as $10/month. Complete Coverage SM plans cover Diagnostics Think X-rays, MRI, blood tests, urinalysis, ... https://www.geico.com/pet-insurance/

Pet insurance can help manage health costs for your pets. Pet insurance is a specialized health insurance for your beloved pets. Get affordable care for your ... https://www.akcpetinsurance.com/

AKC Pet Insurance offers pet insurance to both cats and dogs of all ages and breeds. Get a free quote from our calculator today or call us at 866-725-2747.

|